Salary paycheck calculator georgia

Below are your Georgia salary paycheck results. The Georgia dual scenario salary paycheck calculator can be used to compare your take-home pay in different Georgia salary scenarios.

How To Create Payroll Salary Sheet Payslip In Excel Hindi Excel Payroll Microsoft Excel

Calculates Federal FICA Medicare and.

. Just enter the wages tax withholdings and other information required. Georgia Hourly Paycheck Calculator Results. The Georgia state tax furniture the following contain relevent tax rates plus thresholds that use to Georgia salary calculations and they are used in the Atlanta salary calculators released on.

A free calculator to convert a salary between its hourly biweekly monthly and annual amounts. Use ADPs Georgia Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Paycheck Results is your gross pay and specific deductions from your paycheck Net Pay is.

The state income tax rate in Georgia is progressive and ranges from 1 to 575 while federal income tax rates range from 10 to 37 depending on your income. Calculate your net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year.

For example if an employee earns 1500. Calculate your Georgia net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and. Georgia Salary Paycheck and Payroll Calculator.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Paycheck Results is your gross pay and specific. Georgia has their minimum wage rate set at 515 but.

Supports hourly salary income and multiple pay frequencies. For 2022 the minimum wage in Georgia is 725 per hour. Enter Your Salary and the.

Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Georgia. Switch to Georgia dual hourly calculator. This free easy to use payroll calculator will calculate your take home pay.

Follow these simple steps to calculate your salary after tax in Georgia using the Georgia Salary Calculator 2022 which is updated with the 202223 tax tables. Georgia Salary Paycheck Calculator. Georgia Hourly Paycheck Calculator.

The Georgia Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Georgia State. How to calculate annual income. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

The results are broken up into three sections. Related Take Home Pay Calculator. Hourly employees who work more than 40 hours per week are paid at 15 times the regular pay rate.

Calculating your Georgia state income tax is similar to the steps we listed on our Federal paycheck calculator. Below are your Georgia salary paycheck results. Federal Salary Paycheck Calculator.

While Georgia has one of the lowest statewide. So the tax year 2022 will start from July 01 2021 to June 30 2022. The results are broken up into three sections.

In Georgia taxpayers can claim a standard deduction of 4600 for single filers and 6000 for joint filers.

Georgia Salary Calculator 2022 Icalculator

Georgia Paycheck Calculator Smartasset

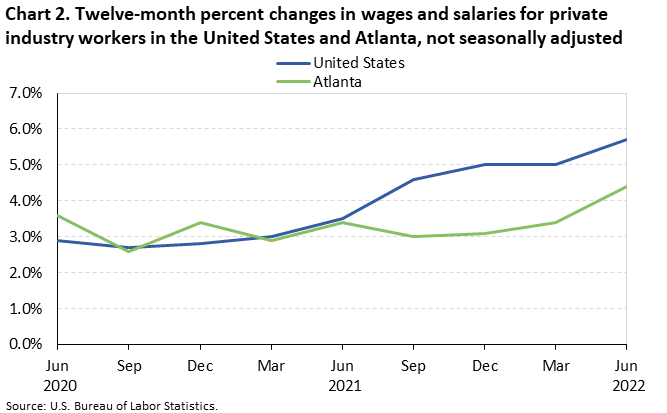

Changing Compensation Costs In The Atlanta Metropolitan Area June 2022 Southeast Information Office U S Bureau Of Labor Statistics

Overtime For Salaried Employees Clicktime

32ec7447bfce9c972260b146d730c52af571e634334243f5e7 Pimgpsh Fullsize Distr Chicago Metro San Mateo County Salary Calculator

Georgia Paycheck Calculator Smartasset

Create Pay Stubs Instantly Generate Check Stubs Form Pros

![]()

Georgia Paycheck Calculator 2022 With Income Tax Brackets Investomatica

Hourly Paycheck Calculator Calculate Hourly Pay Adp

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

Calculate Civilian Equivalent Pay For Single 6 Year O 3 W No Dependents Finance Paycheck Paying

80 000 Income Tax Calculator New York Salary After Taxes Income Tax Payroll Taxes Salary

Payroll Tax What It Is How To Calculate It Bench Accounting

Paycheck Calculator Georgia Ga Hourly Salary

Ppc Jobs Salary Guide Infographic Salary Guide Marketing Jobs Digital Marketing Manager

Payroll Software Solution For Georgia Small Business

Free Georgia Payroll Calculator 2022 Ga Tax Rates Onpay